Rapid developments in technology, demographics, society and the environment are leading many boards of directors to rethink and adapt its corporation’s mission, as well as its strategic plans and objectives. It is in this evolving business environment that institutional investors are seeking greater transparency and enhanced disclosure on boardroom priorities. Other stakeholders, including employees, the broader workforce, customers, suppliers and the surrounding communities, are also gaining prominence in the governance landscape, prompting organizations to consider a multi-stakeholder approach to long-term investment and growth.

In light of these factors, it is critical that boards of directors communicate and engage with stakeholders on governance principles. The Nasdaq Center for Corporate Governance, which launched in mid-June, recently issued a report, “Where Board & Investor Priorities Intersect.” The report examines the corporate practices and disclosures of S&P 100 companies, where mainstream practices often first emerge. Specifically, the report focuses on six key areas: governance highlights, board composition, information technology, human capital management, environmental matters and business sustainability, and investor engagement and communications. The report’s key findings follow below.

By analyzing proxy statements, the report found that good governance principles, supported by effective reporting and disclosure, are emerging. Still, there are opportunities to improve engagement on governance matters and strengthen relationships with principal stakeholders.

Governance Highlights

Increasingly, companies are leveraging the proxy statement to communicate governance practices, including language on their purpose, mission, vision, strategy, objectives, cultures and values. The Center found that 86% of reviewed companies discussed their governance practices through a “Governance Highlights” section, while about 64% highlight their purpose and mission. Nearly half of the companies reviewed (48%) mentioned company culture and values, but given “broader stakeholder attention to these topics, related disclosure may continue to grow,” the report stated.

Board Composition

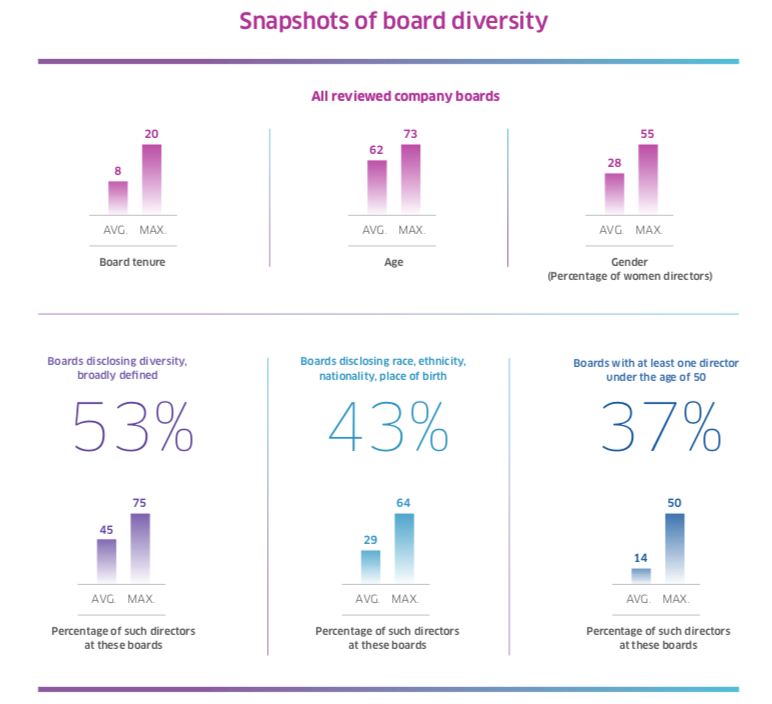

Investors have increasingly called attention to boardroom composition in recent years, leading companies to use a skills matrix to outline the board’s expertise in particular areas, such as technology, regulation and finance. Companies are also addressing boardroom diversity. Fifty-three percent of the reviewed companies disclosed a “combined” diversity figure, representing gender diversity and other definitions, such as race, ethnicity, nationality or place of birth.

Information Technology

Companies across all sectors are seeking to leverage new and developing technologies for a competitive advantage. To communicate to investors that information technology is a priority, some companies are using the proxy statement to disclose their objectives and highlight directors with technology expertise. While 85% of the reviewed S&P 100 proxy statements included information technology in a skills matrix or director qualifications, only 29% of those companies identify information technology as a strategic priority in the message to shareholders.

That said, cybersecurity is a top priority for most companies, with 52% saying their boards have a director with cybersecurity expertise. More than three-quarters of companies (82%) formally charge a board-level committee, often the audit committee, with oversight of cybersecurity. In comparison, only 10% assign a board committee with monitoring information technology from an innovation or growth perspective.

Human Capital Management

Board-level attention to broader workforce matters has grown in recent years, according to the report. The Center found that 51% of S&P 100 companies say HCM is a priority in the proxy filing, with 48% noting board-level experience on talent matters. Furthermore, the most common engagement topic discussed with stakeholders is compensation, with environmental and social issues, including corporate culture and human capital management, were the second-most-common.

Environmental Matters and Business Sustainability

Investor interest in environmental matters and business sustainability has reached new heights in the last couple of years, with more investors incorporating ESG into their investment decisions. Because of this shift in assets, more companies are disclosing their efforts and metrics in ESG. In fact, 80% of reviewed companies highlight environmental and sustainability initiatives in their proxy statements, and even more (91%) have posted a sustainability report.

That said, “there appears to be an opportunity for enhanced – though not necessarily more – disclosure regarding how the board and company are addressing the governance of environmental and social topics, given that this represents one of the most common issues raised in company-investor conversations,” the report said.

Investor Engagement and Communications

The rapidly-evolving competitive environment has brought company-investor engagement into the mainstream, and related disclosure has grown. “Companies appear to be featuring these disclosures as an additional way to highlight strong governance practices to their broader base of investors and stakeholders,” according to the report.

An overwhelming majority (92%) of companies disclosed shareholder engagement activity and 58% note that directors may participate in these activities. Two-thirds revealed efforts to reach out to institutional investors.

Microsoft’s (MSFT) 2018 proxy statement offered a prime example of an investor-related disclosure, in which the tech giant said:

“In fiscal year 2018, the office of the corporate secretary engaged shareholders representing over 46% of our shares. Our independent chairman of the board frequently participates in shareholder meetings, and shareholder feedback is provided to relevant committees and the full board.”

These six areas emphasize the shift in board and investor engagement as it relates to governance priorities, but there is still an opportunity for organizations to enhance dialogue on critical matters. Importantly, the Center said that companies must redouble their efforts to stay attuned to what their stakeholders are saying and seeking.

“With the changing landscape, it becomes more important than ever to communicate effectively the ongoing work of the board and company, and to show how this connects to strategy and long-term business sustainability and success,” the report concluded.

To read the full report, click here

COMMENTS ARE OFF THIS POST